In partnership with MiCodmc, a selection of establishments ripe for discovery during the 63rd edition of the Salone del Mobile.Milano, from 8th to 13th April

The salient points of the 2023 report, touching on economies, fields of operation and division of labour, mapping out a path towards strengthening ecological and social transition objectives

Every year, the Symbola Foundation – along with Deloitte.Private and Poli.Design – produces its Design Economy Report, flagging up data and information on the design sector economy – along with all the systems that gravitate around it, such as geography and training.

The emblematic opening, which quotes Alexander Langer’s decisive statement “We will only attain ecological conversion when it becomes socially desirable,” reflects the contemporary need to fast-track a number of changes, whilst also revealing a widespread acceptance of the need to concretise them. The direction signposted by this statement is thus in line with international objectives geared to trying to steer the industries towards producing increasingly environmentally and socially sustainable goods and services. It is this change of paradigm that will ultimately serve to make design firms more competitive.

Design companies in Europe

There are 222,390 companies operating in the design sector within the European Union, and the highest percentage of these are in Italy, making up 16.2% of the total – the same as in France. Over the last few years, the number of French design companies has seen a slightly greater increase than in Italy (+8.3% compared with +6.5%) but, while France accounts for 10.7% of the sector’s total turnover in Europe, Italy accounts for 19.9% of it. Moreover, the companies active in the design field in Italy account for 19.1% of all employees (a total of 283,685 in Europe as a whole), whilst in Spain in particular there seems to be a significant increase in jobs within the sector, illustrated by a positive variation between 2019 and 2020 with 16.4% growth.

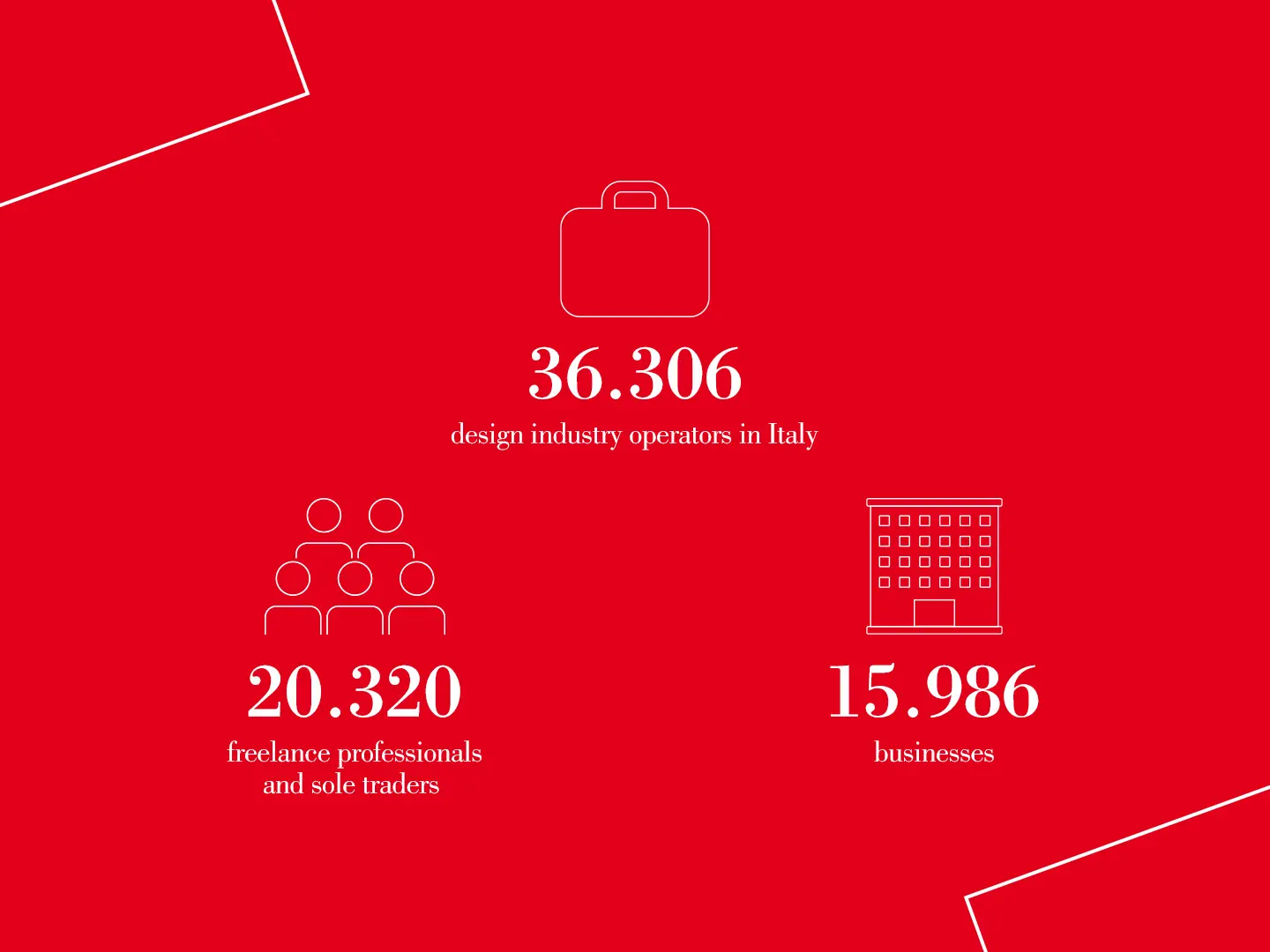

The design workers

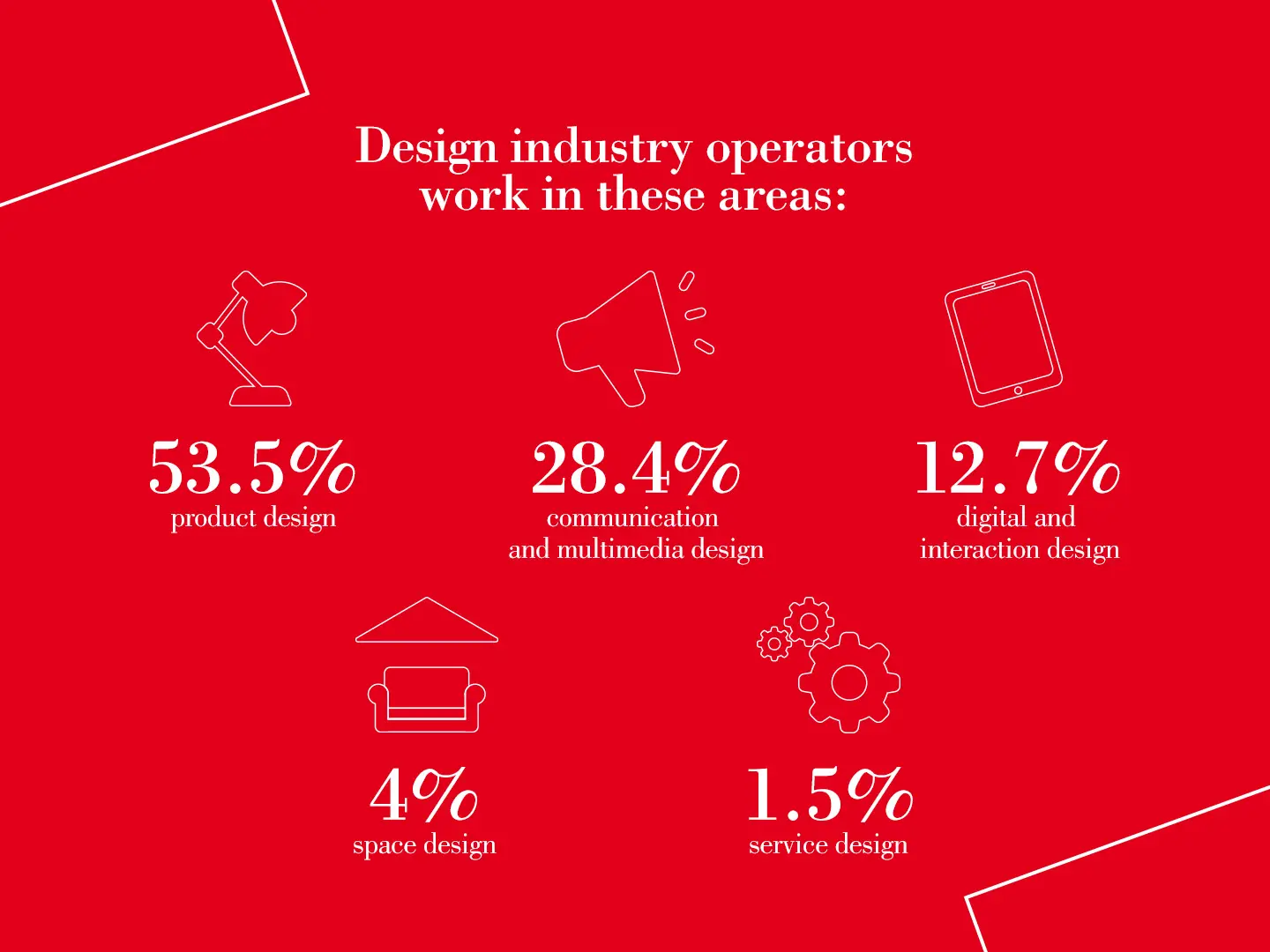

More than 63,000 people work in the design sector in Italy, of whom nearly 16,000 are employed by companies and around 20,000 are self-employed freelancers. Altogether, there are a total of 36,306 businesses active in the design sector, 53.5% of them specialising in product design, 28.4% in multimedia design, 12.7% in spatial design, 4% in digital and interaction design and, lastly, 1.5% in service design.

Broken down into these sub-sectors, freelancers largely work in the fields of product and spatial design (accounting for 67% and 70.3% of professionals within both sectors respectively), whilst companies are particularly active in the fields of communication and multimedia design (67.7%, equally split between firms with up to 10 employees and firms with more than 10 employees), and between digital, interaction and service design, a sector in which a good 65.7% operate with more than 10 employees. However, it is the furnishing sector that drives the greatest demand for their services (14.3%), followed by manufacturing in general, lighting design, construction, tourism, hospitality and mechanical automation.

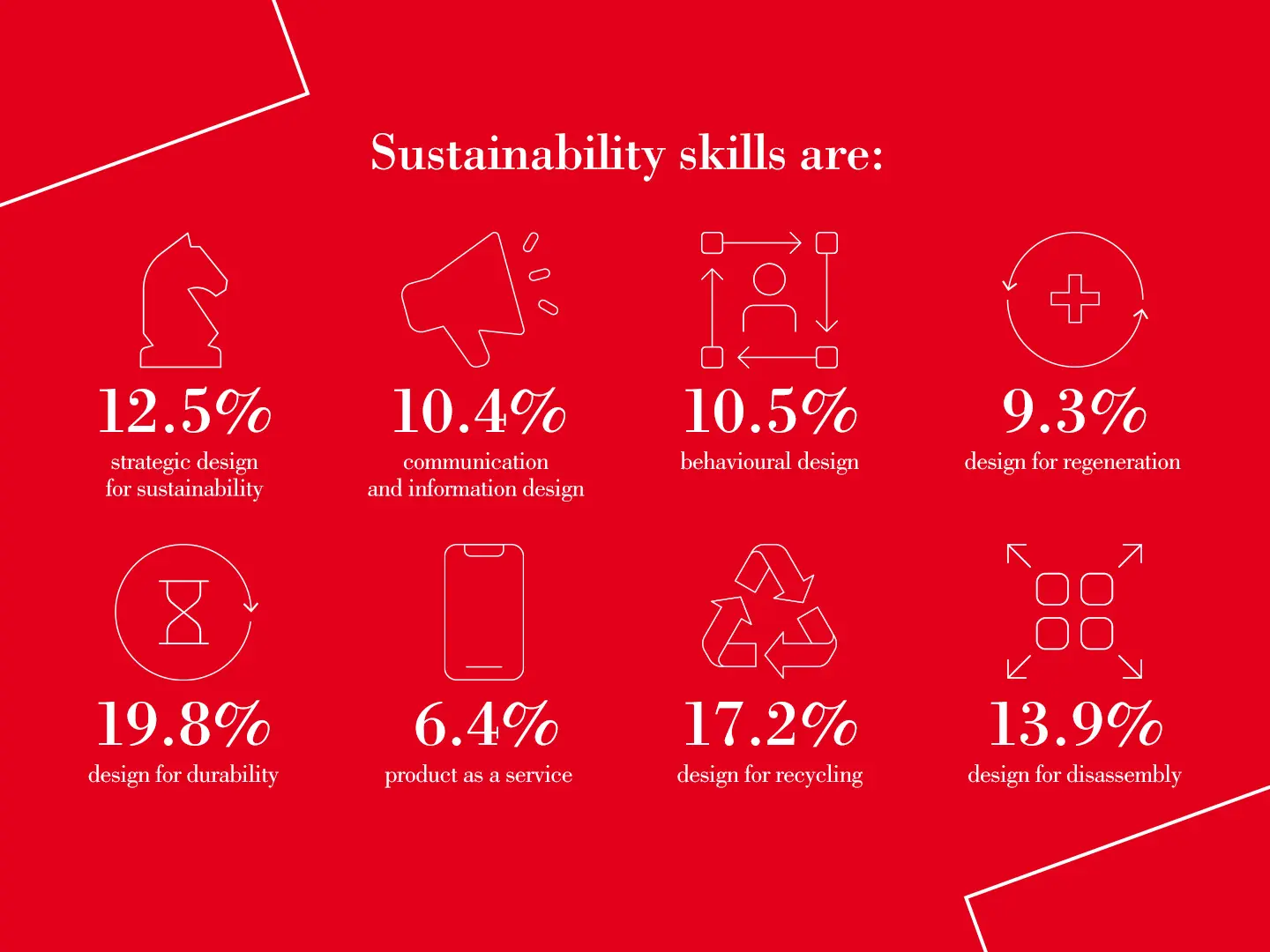

The challenges facing the companies: sustainability and ecological and social transition

Aside from the main sectors of activity, of which both manufacturing and multimedia design and production stand out, many different organisations operating within the sector also offer consultancy services. Of these, 31.9% offer design support services – such as modelling, prototyping, testing, post-production etc. – followed by strategic consulting, research and then marketing. Within this context, it should be noted that of all consultancy services, the greatest demand amongst the majority of firms with 10 or more employees is for social and environmental impact measuring, services demanded by 60.8% of those operating in the field of product design – to the extent that 60.4% of expertise related to design for environmental sustainability is concentrated in product design companies or freelance professionals.

Thus, as the report underscores, “if on one hand designers are willing to respond to the demand for eco-design services (86.9% of whom claim expertise in the environmental field and 72.5% in the social field), on the other it would seem that business demand is tending gradually towards a greater awareness of sustainability-related issues. [...] Clearly companies are beginning to take ESG issues on board, although there would appear to be greater sensitivity towards environmental issues, over and above social and governance aspects.”

Although significantly greater focus is currently being brought to bear on environmental matters, implementing ESG goals and criteria in a business context also brings advantages in terms of competitivity, strengthening customer relationships and financial credibility. Therefore, although the manufacturing supply chain is currently driving demand for eco-design services (furnishing first and foremost, accounting for 12.5% of activities in this field, followed by packaging, construction, clothing and automotive), triggering virtuous supply chains more generally will generate a rise in production and organisational standards, adding value and therefore also impacting social spheres and governance.

Markets

Markets